Twin Win Certificates

Cosa sono i Twin Win Certificate

I Twin Win Certificate sono strumenti finanziari appartenenti alla categoria dei Certificate a capitale condizionatamente protetto che permettono di investire su un’attività finanziaria sottostante, quale da esempio un’azione, un indice azionario, una valuta, una materia prima o un tasso di interesse. La loro peculiarità è quella di permettere agli investitori, a scadenza ed entro determinati limiti fissati in fase di emissione del Certificate, di partecipare alla performance in valore assoluto, sia positiva che negativa (in modo favorevole all’investitore) registrata dal sottostante. La misura della partecipazione alla performance dell’attività finanziaria sottostante è prefissata in fase di emissione del Certificate. La condizione perché questo avvenga è che il sottostante a scadenza valga più di un livello determinato in fase di emissione del Certificate. Detta soglia è chiamata livello barriera e la sua violazione fa perdere la protezione condizionata del capitale, con conseguente perdita del valore dell’investimento per il detentore del Certificate.

A chi si rivolgono i Twin Win Certificate

Per le loro caratteristiche, i Twin Win Certificate sono strumenti che possono risultare idonei ad investitori con elevata propensione al rischio, senza aspettative direzionali sull’evoluzione del valore dell’attività finanziaria sottostante. Investitori che vogliono proteggere, entro certi livelli fissati in fase di emissione del Certificate, il loro investimento e guadagnare anche in caso di moderato andamento negativo del sottostante.

Strumenti che offrono la possibilità di ottenere un rendimento positivo sia in caso di rialzi che di ribassi del sottostante

Quotazione e negoziazione dei Twin Win Certificate

I Twin Win Certificate sono strumenti finanziari che, in Italia, possono essere acquistati o venduti sui sistemi multilaterali di negoziazione SeDeX e EuroTLX di Borsa Italiana. Le modalità e orari di negoziazione presso tali sistemi multilaterali di negoziazione sono specificati nei relativi regolamenti disponibili sul sito internet di Borsa Italiana. Ad esempio, le negoziazioni continue possono avvenire nei giorni di mercato aperto dalle 9:05 alle 17:30 sul SeDeX e dalle 9:00 alle 17:30 su EuroTLX

Caratteristiche dei Twin Win Certificate

- SOTTOSTANTE: ossia l’azione, l’indice azionario, la valuta, la materia prima o qualsiasi altro asset finanziario o reale da cui dipende il valore del Certificate;

- VALORE DI RILEVAZIONE INIZIALE: ossia il prezzo di rilevazione iniziale dell’attività sottostante rilevato nella data prefissata in fase di emissione del Certificate;

- LIVELLO BARRIERA: ossia il valore o prezzo del sottostante sotto il quale l’investitore perde la protezione del capitale;

- SCADENZA: ossia la data in cui il Certificate cessa di esistere;

- EMITTENTE: ossia l’istituzione finanziaria che ha emesso il Certificate;

- LOTTO MINIMO: ossia il numero minimo di Certificate che possono essere acquistati o venduti;

- ISIN: ossia il codice alfanumerico che identifica in modo univoco lo strumento finanziario;

- FATTORE DI PARTECIPAZIONE UP: espresso in termini percentuali, rappresenta il valore moltiplicativo della performance maturata dall’attività finanziaria sottostante che viene riconosciuto all’investitore (in caso di rialzo del sottostante);

- FATTORE DI PARTECIPAZIONE DOWN: espresso in termini percentuali, rappresenta il livello di partecipazione, a scadenza, all’eventuale performance negativa del sottostante.

Funzionamento dei Twin Win Certificate

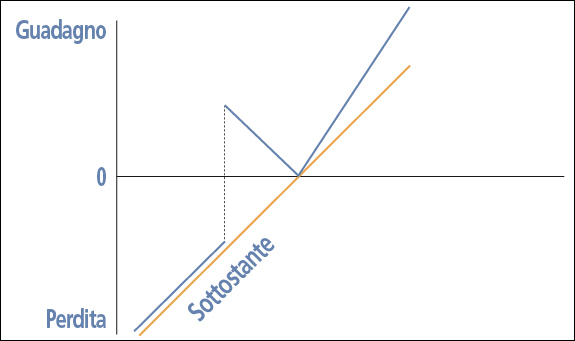

I Twin Win sono Certificati adatti a sfruttare le situazioni di incertezza dei mercati finanziari. A scadenza consentono di trarre beneficio:

- dalle performance positive dall’attività finanziaria sottostante, partecipando alle stesse con un fattore di partecipazione predeterminato;

- dalle eventuali performance negative dell’attività finanziaria sottostante convertendo in guadagno le stesse, eventualmente ponderate attraverso un fattore di partecipazione predeterminato.

La possibilità di beneficiare dei movimenti del sottostante, sia in caso di ribasso che di rialzo, si ha fino a quando non viene raggiunto il livello barriera. In tal caso il Certificate perde la protezione condizionata del capitale e l’investitore matura quindi una perdita commisurata a quella che avrebbe avuto investendo direttamente nel sottostante alla data di rilevazione iniziale del Certificate. La partecipazione al movimento del sottostante da parte del Certificate può essere minore, uguale o maggiore a seconda del fattore di partecipazione prefissato dall’emittente in fase di emissione del Certificate.

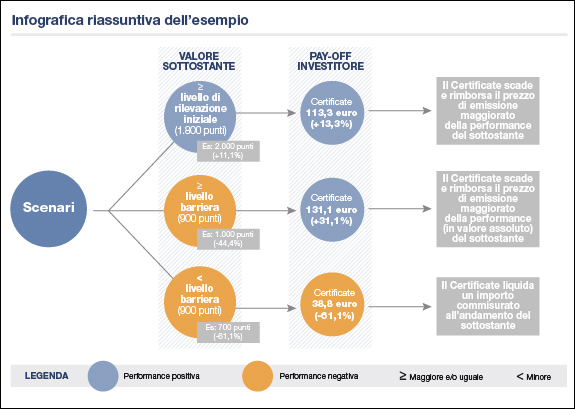

Esempio funzionamento Twin Win Certificate

Si ipotizzi un Twin Win Certificate su un indice emesso il 21 luglio 2014. Il Certificate, con un prezzo di emissione pari a 100 euro, ha una durata di 2 anni e scade il 21 luglio 2016. Il valore di rilevazione iniziale dell’indice azionario sottostante il Certificate è stato fissato in fase di emissione a 1.800 punti. Il fattore di partecipazione al rialzo è pari al 120%, il fattore di partecipazione al ribasso è pari al 70%. Il livello barriera in fase di emissione è stato determinato nel 50% del valore di rilevazione iniziale, ossia a 900 punti. Alla scadenza del Certificate viene rilevato il valore dell’attività finanziaria sottostante. Gli scenari possibili per l’investitore sono tre:

- il livello di rilevazione finale è superiore o uguale al livello di rilevazione iniziale:

la performance maturata dal sottostante nel periodo di vita del Certificate viene moltiplicata per il fattore di partecipazione al rialzo e viene riconosciuta, in aggiunta al prezzo di emissione del Certificate, all’investitore. Ipotizzando un valore dell’indice a scadenza di 2.000 punti (+11,1%), il valore di rimborso del Certificate sarebbe pari a 113,3 euro (+13,3%); - il livello di rilevazione finale è inferiore al livello di rilevazione iniziale ma superiore o uguale al livello barriera:

la performance negativa maturata dal sottostante nel periodo di vita del Certificate viene moltiplicata per il fattore di partecipazione al ribasso e viene riconosciuta, in aggiunta al prezzo di emissione del Certificate, all’investitore. Ipotizzando un valore dell’indice a scadenza di 1.000 punti (-44,4%), il valore di rimborso del Certificate sarebbe pari a 131,1 euro (+31,1%); - il livello finale è inferiore al livello barriera:

l’investitore ottiene un importo di liquidazione commisurato alla performance negativa maturata nel periodo di vita del Certificate e, per ogni strumento detenuto, incassa un valore inferiore al prezzo di emissione del Certificate. Ipotizzando un valore dell’indice a scadenza di 700 punti (-61,1%), il valore di rimborso del Certificate sarebbe pari a 38,8 euro (-61,1%).

Grafico payoff dei Twin Win Certificate

Per approfondimenti sui termini è possibile consultare l' apposito GLOSSARIO