Cash Collect Certificate

Cosa sono i Cash Collect Certificate

I Cash Collect Certificate sono strumenti finanziari che permettono di investire su un’attività finanziaria sottostante, quale ad esempio un’azione, un indice azionario, una valuta, una materia prima o un tasso di interesse. La loro peculiarità è quella di distribuire nel corso della vita del Certificate dei premi fissi incondizionati, ossia indipendenti dall’andamento dell’attività sottostante, e/o dei premi condizionati, ossia subordinati al verificarsi di alcune condizioni. Alla scadenza del Certificate all’investitore sarà restituito il prezzo di emissione maggiorato di un premio, se l’attività sottostante avrà un valore superiore o uguale ad un determinato livello fissato in fase di emissione, chiamato Livello Barriera. Se il sottostante, a scadenza, avrà un valore inferiore al Livello Barriera, il Certificate rimborserà un importo commisurato alla performance del sottostante: l’investitore subirà conseguentemente una perdita inferiore rispetto a quella che avrebbe ottenuto investendo direttamente nell’attività sottostante grazie ai premi incondizionati incassati.

A chi si rivolgono I Cash Collect Certificate

I Cash Collect Certificate sono strumenti rivolti ad investitori con aspettative rialziste, di stabilità o moderato ribasso (nel caso di Cash Collect Long) del valore dell’attività finanziaria sottostante. Il capitale investito nei Cash Collect Certificate è protetto solo se a scadenza il sottostante non scende sotto un certo livello, determinato in percentuale rispetto al valore di riferimento iniziale (esempio l’80%), chiamato Livello Barriera. Il prodotto si rivolge ad un investitore avente orizzonte temporale di breve-medio periodo, un buon livello di conoscenza ed esperienza in materia di strumenti finanziari ed una elevata propensione al rischio.

Quotazione e negoziazione dei Cash Collect Certificate

I Cash Collect Certificate sono strumenti finanziari che, in Italia, possono essere acquistati o venduti sui sistemi multilaterali di negoziazione SeDeX e EuroTLX di Borsa Italiana. Le modalità e orari di negoziazione presso tali sistemi multilaterali di negoziazione sono specificati nei relativi regolamenti disponibili sul sito internet di Borsa Italiana. Ad esempio, le negoziazioni continue possono avvenire nei giorni di mercato aperto dalle 9:05 alle 17:30 sul SeDeX e dalle 9:00 alle 17:30 su EuroTLX.

Caratteristiche dei Cash Collect Certificate

- SOTTOSTANTE: ossia l’azione, l’indice azionario, la valuta, la materia prima o qualsiasi altro strumento finanziario o reale da cui dipende il valore del Certificate;

- VALORE DI RILEVAZIONE INIZIALE o STRIKE PRICE: ossia il prezzo di rilevazione iniziale dell’attività sottostante rilevato nella data prefissata in fase di emissione del Certificate;

- LIVELLO BARRIERA: ossia il valore o prezzo del sottostante sotto il quale l’investitore perde la protezione del capitale;

- SCADENZA: ossia la data in cui il Certificate cessa di esistere;

- EMITTENTE: ossia l’istituzione finanziaria che ha emesso il Certificate;

- LOTTO MINIMO: ossia il numero minimo di Certificate che possono essere acquistati o venduti;

- ISIN: ossia il codice alfanumerico che identifica in modo univoco lo strumento finanziario;

- PREMIO PLUS (INCONDIZIONATO): ossia il premio distribuito all’investitore indipendentemente dall’andamento del sottostante;

- PREMIO DIGITAL (CONDIZIONATO): ossia il premio distribuito all’investitore se il valore del sottostante alla data di valutazione digital è pari o superiore al Livello Barriera;

- PREMIO A SCADENZA (CONDIZIONATO): ossia il premio distribuito a scadenza nel caso in cui il sottostante alla data di valutazione finale sia pari o superiore al Livello Barriera;

- MULTIPLO: ossia la quantità di sottostante controllata da ciascun Certificate e pari al rapporto tra il prezzo di sottoscrizione in fase di emissione del Certificate e il Valore di Riferimento Iniziale dell’attività finanziaria sottostante

Funzionamento dei Cash Collect Certificate

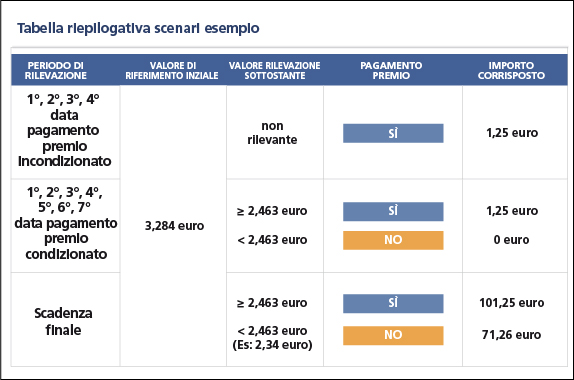

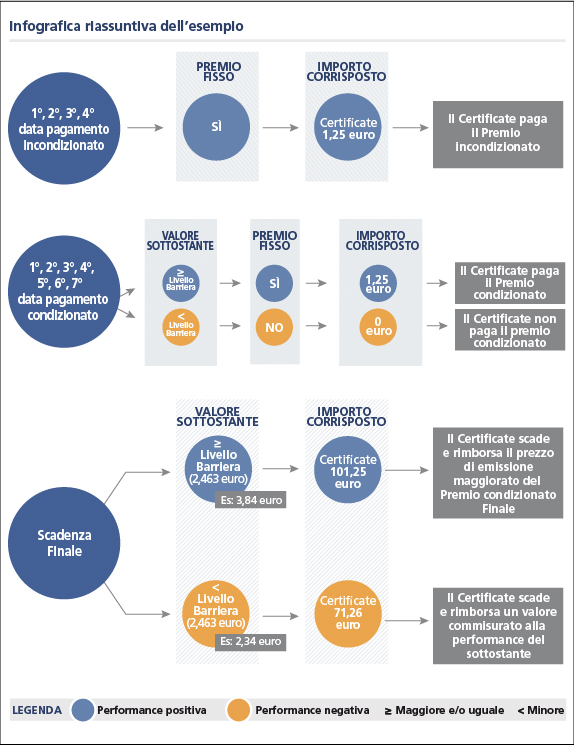

Durante la vita del Certificate, i Cash Collect Certificate prevedono la distribuzione di premi fissi indipendentemente dall’andamento dell’attività finanziaria sottostante. Il pagamento di questi premi avviene a date prestabilite fissate in fase di emissione del Certificate. Oltre ai premi fissi, i Cash Collect Certificate prevedono il pagamento di premi condizionati se alle date prestabilite fissate in fase di emissione l’attività finanziaria sottostante ha un valore pari o superiore al Livello Barriera. Alla scadenza dello strumento finanziario sono due i possibili scenari che si possono manifestare all’investitore:

- il valore finale dell’attività finanziaria sottostante è uguale o maggiore al Livello Barriera: in questo caso il Certificate rimborsa il prezzo di emissione maggiorato di un premio prefissato;

- il valore finale dell’attività finanziaria sottostante è minore del Livello Barriera: in questo caso l’investitore riceve un importo di rimborso correlato con l’andamento del sottostante.

Esempio di funzionamento

Si ipotizzi un Cash Collect Certificate con sottostante il titolo azionario UBI Banca e avente le seguenti caratteristiche:

| Scadenza | 1 anno |

|---|---|

| Prezzo di emissione | 100€ |

| Data di rilevazione iniziale | 16/01/2017 |

| Valore di Riferimento iniziale | 3,284 € |

| Premi condizionati e incondizionati | 1,25 € |

| Data di pagamento premi incondizionati | 16 febbraio - 16 marzo - 18 aprile - 16 maggio 2017 |

| Data pagamento premi condizionati | 16 giugno - 17 luglio - 16 agosto - 18 settembre - 16 ottobre - 16 novembre - 16 dicembre 2017 - 16 gennaio 2018 |

| Data di rilevazione finale | 11/01/2018 |

| Premio a scadenza condizionato | 1,25 € |

| Multiplo | 30,45067 |

| Livello barriera | 2,463 € (pari al 75% del Valore di riferimento iniziale) |

Avendo una durata di 12 mesi e prevedendo il pagamento di 4 premi mensili incondizionati e 8 premi mensili condizionati, l’investitore otterrà 1,25 euro del premio incondizionato nelle date del 16 febbraio, 16 marzo, 18 aprile e 16 maggio 2017. Il Cash Collect Certificate pagherà inoltre un premio mensile condizionato di 1,25 euro il 16 giugno, 17 luglio, 16 agosto, 18 settembre, 16 ottobre, 16 novembre, 16 dicembre 2017 se alle rispettive date di valutazione il valore di UBI Banca sarà uguale o superiore ai 2,463 euro del Livello Barriera. A scadenza, il 16 gennaio 2018, due i possibili scenari che si prospettano all’investitore:

- l’azione UBI Banca quota a un livello pari o superiore al Livello Barriera (2,463 euro). Per esempio, se UBI Banca vale 3,84 euro l’investitore riceve il prezzo di emissione di 100 euro maggiorato del premio condizionato di 1,25 euro per un totale di 101,25 euro per ogni Certificate sottoscritto;

- l’azione UBI Banca quota a un livello inferiore al Livello Barriera (2,463 euro). Per esempio, se UBI Banca vale 2,34 euro l’investitore perde la possibilità di incassare l’ultimo premio condizionato di 1,25 euro e perde la protezione condizionata del capitale registrando una perdita. L’attività finanziaria sottostante ha registrato una performance negativa del 28,74%. Di conseguenza, per ogni Certificate detenuto, all’investitore saranno corrisposti 71,26 euro.

Per approfondimenti sui termini è possibile consultare l' apposito GLOSSARIO