Cosa sono i Leva Fissa Certificate

Cosa sono gli Indici a Leva

I Leva Fissa Certificate sono strumenti finanziari a capitale non protetto che offrono la possibilità di investire con l’obiettivo di replicare l’andamento di un Indice a Leva.I Leva Fissa Certificate prevedono una commissione posta a carico dell’investitore detta Variable Management Fee o VMFₜ, calcolata mediante l’applicazione di una formula predefinita che tiene conto dell’AMF Percentage e della VMF Percentage e che comporta la riduzione dell’importo di liquidazione a favore dell’investitore. Inoltre, essendo calcolata progressivamente e quotidianamente, incide sul valore di mercato del Certificate durante tutta la sua vita. Tali Certificate sono pensati per un’operatività di breve e brevissimo termine, anche intraday.

Leva Fissa Certificate

A chi si rivolgono i Leva Fissa Certificate

Strumenti finanziari che replicano l’andamento di un Indice a Leva

Quotazione e negoziazione dei Leva Fissa Certificate

I Leva Fissa Certificate sono strumenti finanziari che, in Italia, possono essere acquistati o venduti sul sistema multilaterale di negoziazione SeDeX di Borsa Italiana. Le modalità e gli orari di negoziazione sono specificati nel relativo regolamento disponibile sul sito internet di Borsa Italiana. Ad esempio, le negoziazioni continue sul SeDeX possono avvenire nei giorni di mercato aperto dalle 9:05 alle 17:30.

Caratteristiche dei Leva Fissa Certificate

- ISIN: il codice alfanumerico che identifica in modo univoco il Certificate;

- SOTTOSTANTE: Indice a Leva;

- EMITTENTE: il soggetto finanziario che ha emesso il Certificate;

- LOTTO MINIMO: il numero minimo di Certificate che possono essere acquistati o venduti;

- MULTIPLO: la quantità di sottostante controllata da ciascun Certificate;

- SCADENZA: la data in cui il Certificate è rimborsato e cessa di esistere;

- AMF Percentage: valore percentuale annuo che è parte della formula con cui viene calcolata la VMFₜ;

- VMF Percentage: valore percentuale annuo che può variare all’interno di un determinato range ed è parte della formula con cui viene calcolata la VMFₜ;

- Variable Management Fee o VMFₜ: commissione posta a carico dell’investitore, calcolata su base giornaliera tenendo conto dell’AMF Percentage e della VMF Percentage ed espressa come coefficiente di aggiustamento (inferiore a 1), calcolato progressivamente e quotidianamente durante la vita del Certificate. Applicato al valore dell’attività sottostante, determina l’effettivo contributo dell’andamento della stessa attività sottostante alla performance del Certificato. Tale coefficiente viene aggiornato dopo la chiusura giornaliera del mercato di negoziazione.

Caratteristiche degli Indici a Leva

INDICE A LEVA: amministrato da un index administrator (soggetto terzo rispetto all’Emittente e da quest’ultimo indipendente), amplifica la performance giornaliera di un’Attività di Riferimento applicando la Leva Fissa, con una strategia al rialzo (Indici a Leva Long) o al ribasso (Indici a Leva Short).

- ATTIVITÀ DI RIFERIMENTO: a titolo esemplificativo un indice azionario, un’azione, una materia prima o un future su di essi;

- LEVA FISSA: fattore che, moltiplicato per la performance giornaliera dell’Attività di Riferimento, consente di amplificare l’esposizione dell’Indice a Leva su di essa e, conseguentemente, del Certificato che lo replica;

- TIPOLOGIA INDICE A LEVA (LONG O SHORT): la direzionalità dell’Indice a Leva che può essere Long (se l’Indice a Leva replica al rialzo l’andamento dell’Attività di Riferimento) o Short (se l’Indice a Leva replica al ribasso l’andamento dell’Attività di Riferimento);

- VALORE DELL’INDICE A LEVA - CALCOLO GIORNALIERO DELLA PERFORMANCE DELL’ATTIVITA’ DI RIFERIMENTO: il valore dell’Indice a Leva è determinato sulla base di un meccanismo di calcolo giornaliero della performance dell’Attività di Riferimento rispetto al suo livello di chiusura del giorno lavorativo precedente. Il valore di riferimento dell’Indice a Leva viene inizialmente fissato alla data di lancio del Certificate. Successivamente, su base giornaliera, viene ricalcolato applicando al valore di chiusura registrato dall’Indice a Leva il giorno lavorativo precedente un importo determinato sulla base della performance dell’Attività di riferimento moltiplicata per la Leva Fissa2;

- COMPOUNDING EFFECT: in un periodo di due o più giorni il meccanismo di calcolo, su base giornaliera, della performance dell’Attività di Riferimento genera il Compounding Effect, per cui la performance complessiva dell’indice a Leva e quindi del Leva Fissa Certificate, in un arco di tempo superiore alla singola giornata di contrattazione, potrebbe differire rispetto alla performance dell’Attività di Riferimento moltiplicata per la Leva Fissa².

- AGGIUSTAMENTI STRAORDINARI PER I MOVIMENTI ESTREMI DI MERCATO: in caso di variazioni consistenti e avverse della performance dell’Attività di Riferimento, è previsto un meccanismo di ricalcolo infragiornaliero (reset infragiornaliero) al fine di evitare che il valore dell’Indice a Leva diventi negativo a causa della Leva Fissa. In particolare, quando la performance dell’Attività di Riferimento supera una determinata soglia (trigger value), l’index administrator fissa un nuovo valore di base per il calcolo della performance giornaliera dell’Attività di Riferimento e, conseguentemente, determinerà un aggiustamento del valore dell’Indice a Leva. Pertanto, in questo caso, la performance dell’Indice a Leva potrebbe differire in modo significativo dalla performance dell’Attività di Riferimento moltiplicata per la Leva Fissa.

Per maggiori informazioni sulle caratteristiche proprie degli Indici a Leva, è possibile consultare il sito internet dell’index administrator che amministra il relativo Indice a Leva.

Funzionamento Leva Fissa Certificate

I Leva Fissa Certificate sono strumenti che hanno l’obiettivo di replicare la performance dell’Indice a Leva, il quale a sua volta amplifica la performance¹ di un’Attività di Riferimento applicando la Leva Fissa. L’importo di liquidazione viene ridotto di una commissione posta a carico dell’investitore (Variable Management Fee o VMFₜ). L’investimento in Leva Fissa Certificate non trae benefici diretti dai proventi nel tempo distribuiti dall’attività finanziaria sottostante e comporta la rinuncia a tali proventi, salvo il caso in cui l’attività finanziaria sottostante sia un indice di tipo Total Return, il cui andamento trae beneficio dai proventi nel tempo distribuiti dai “componenti” dell’indice stesso.

Cos’è l’Indice a Leva?

Esempio funzionamento Leva Fissa Certificate

Si ipotizzi un Leva Fissa Certificate³ avente come attività sottostante l’indice Alfa Leverage Long 7x Index e con le seguenti caratteristiche:

| Valore di riferimento iniziale dell’indice Alfa Leverage Long 7x (giorno T0) | 10.000 punti |

|---|---|

| Valore Iniziale dell’Attività di Riferimento: | 10.000 punti |

| Leva Fissa Long | 7 |

| Scadenza | dopo 3 anni |

| Prezzo di Emissione | 100 € |

| Annual Management Fee Percentage (AMF Percentage) | 3,20% |

| Variable Management Fee Percentage (VMF Percentage) | 4,5% |

| Multiplo | 0,01 |

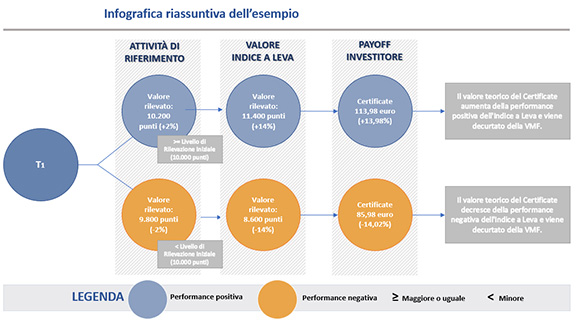

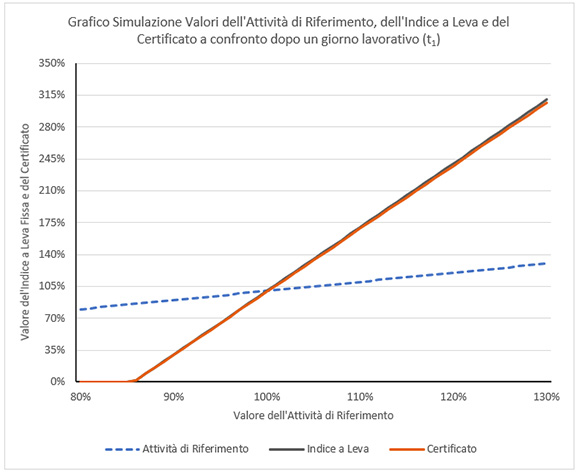

Il valore del Certificate dopo un giorno lavorativo (t₁) può assumere uno dei seguenti valori in base al valore dell’Attività di Riferimento a t₁ e, di conseguenza, dell’Indice a Leva Alfa Leverage Long 7x:

- il valore dell’Attività di Riferimento il giorno successivo è pari a 10.200 punti, con una performance positiva nel periodo pari al 2%. Pertanto, il valore dell’Indice a Leva Alfa Leverage Long 7x il giorno successivo, amplificando la performance giornaliera dell’Attività di Riferimento applicandole la Leva Fissa, è pari a 11.400 punti, con una performance positiva pari al 14%.

La VMFₜ (la commissione posta a carico dell’investitore, calcolata su base giornaliera tenendo conto dell’AMF Percentage e della VMF Percentage ed espressa come coefficiente di aggiustamento) dopo un giorno sarà pari a 0,9998631.Il valore teorico del Certificate passa pertanto a 113,98 euro:

11.400 x 0,01 x 1 x 0,9997892 = 113,98 euro (+13,98% rispetto al prezzo del giorno precedente) - il valore dell’Attività di Riferimento il giorno successivo è pari a 9.800 punti, con una performance negativa nel periodo pari al 2%. Pertanto, il valore di riferimento finale dell’Indice a Leva Alfa Leverage Long 7x il giorno successivo, amplificando la performance giornaliera dell’Attività di Riferimento applicandole la Leva Fissa, è pari a 8.600 punti, con una performance negativa pari a -14%.

Il valore teorico del Certificate passa a 85,98 euro.

8.600 x 0,01 x 1 x 0,9997892 = 85,98 euro (-14,02% rispetto al prezzo del giorno precedente)

Esempio grafico Leva Fissa Certificate

1 Salvo nel caso in cui si verifichi un reset infragiornaliero, che potrebbe comportare un disallineamento significativo fra la performance dell’Indice a Leva e la performance dell’Attività di Riferimento moltiplicata per la Leva Fissa.

2 Il calcolo del valore dell’Indice a Leva da parte dell’index administrator si basa sulla performance giornaliera dell’Attività di Riferimento e include alcuni costi finanziari figurativi, di conseguenza la performance dell’Indice a Leva sarà diversa da quella dell’Attività di Riferimento moltiplicata per la Leva Fissa.

3 Nel seguente esempio non sono considerati (i) i costi finanziari figurativi tenuti in considerazione dall’index administrator per il calcolo dell’Indice a Leva e (ii) le commissioni a carico dell’investitore e relative al Leva Fissa Certificate.

Per approfondimenti sui termini è possibile consultare l' apposito GLOSSARIO