Express Certificate

Cosa sono gli Express Certificate

Gli Express Certificate sono strumenti finanziari appartenenti alla categoria dei Certificate a capitale condizionatamente protetto che permettono di investire su un’attività finanziaria sottostante, quale ad esempio un’azione, un indice azionario, una valuta, una materia prima o un tasso di interesse. La loro peculiarità è quella di poter scadere anticipatamente al verificarsi di predeterminate condizioni stabilite in fase di emissione del Certificate, riconoscendo all’investitore, oltre al prezzo di emissione, un ulteriore importo. La protezione del prezzo di emissione del Certificate è condizionata al mancato raggiungimento di un determinato livello, fissato in fase di emissione del Certificate, da parte dell’attività finanziaria sottostante. Detta soglia è chiamata livello barriera.

A chi si rivolgono gli Express Certificate

Gli Express Certificate sono strumenti rivolti ad investitori con elevata propensione al rischio e con aspettative di stabilità o moderato rialzo (nel caso di Express Long sottostante) del valore dell’attività sottostante. La protezione del capitale che caratterizza gli Express Certificate è condizionata al mancato raggiungimento di determinati livelli fissati in fase di emissione.

Tipologia di Certificate che offre la possibilità di essere remunerati prima della scadenza

Quotazione e negoziazione degli Express Certificate

Gli Express Certificate sono strumenti finanziari che, in Italia, possono essere acquistati o venduti sui sistemi multilaterali di negoziazione SeDeX e EuroTLX di Borsa Italiana. Le modalità e orari di negoziazione presso tali sistemi multilaterali di negoziazione sono specificati nei relativi regolamenti disponibili sul sito internet di Borsa Italiana. Ad esempio, le negoziazioni continue possono avvenire nei giorni di mercato aperto dalle 9:05 alle 17:30 sul SeDeX e dalle 9:00 alle 17:30 su EuroTLX.

Caratteristiche degli Express Certificate

- SOTTOSTANTE: ossia l’azione, l’indice azionario, la valuta, la materia prima o qualsiasi altro asset finanziario o reale da cui dipende il valore del Certificate;

- VALORE DI RILEVAZIONE INIZIALE o STRIKE PRICE: ossia il prezzo di rilevazione iniziale dell’attività sottostante rilevato nella data prefissata in fase di emissione del Certificate;

- LIVELLO BARRIERA: ossia il valore o prezzo del sottostante sotto il quale l’investitore perde la protezione del capitale;

- SCADENZA: ossia la data in cui il Certificate cessa di esistere

- EMITTENTE: ossia l’istituzione finanziaria che ha emesso il Certificate;

- LOTTO MINIMO: ossia il numero minimo di Certificate che possono essere acquistati o venduti;

- ISIN: ossia il codice alfanumerico che identifica in modo univoco lo strumento finanziario;

- LIVELLO DI ESERCIZIO ANTICIPATO: ossia il valore fissato in fase di emissione che permette al Certificate, qualora si verifichi la condizione, di scadere anticipatamente;

- DATE DI RILEVAZIONE INTERMEDIA: ossia quando viene rilevato il valore di mercato dell’attività finanziaria sottostante al fine di verificare la condizione di scadenza anticipata

- IMPORTO DI ESERCIZIO ANTICIPATO: ossia l’importo che viene corrisposto all’investitore al verificarsi della condizione di scadenza anticipata;

- MULTIPLO: ossia la quantità di sottostante controllata da ciascun Certificate e pari al rapporto tra il prezzo di sottoscrizione in fase di emissione del Certificate e il Valore di Riferimento Iniziale dell’attività finanziaria sottostante;

Funzionamento degli Express Certificate

Gli Express Certificate sono strumenti che hanno una durata solitamente pluriennale. La loro specificità è quella di poter scadere anticipatamente in occasione di una delle date di rilevazione intermedia predeterminate in fase di emissione del Certificate. Perché l’Express Certificate scada anticipatamente è necessario che in occasione di una delle date di rilevazione intermedia l’attività finanziaria sottostante quoti ad un valore maggiore o uguale al livello di esercizio anticipato predeterminato in fase di emissione. In genere tale livello corrisponde al valore di rilevazione iniziale dell’attività finanziaria sottostante al Certificate. In caso di scadenza anticipata, l’investitore oltre a ottenere la restituzione del prezzo di emissione del Certificate riceve un ulteriore importo stabilito in fase di emissione del Certificate. Qualora un Express Certificate giunga alla scadenza finale senza aver soddisfatto i requisiti richiesti per la scadenza anticipata, sono tre i possibili scenari che a scadenza si possono manifestare all’investitore:

- il valore dell’attività finanziaria sottostante è uguale o maggiore al livello di esercizio finale: l’investitore ottiene il pagamento del prezzo di emissione del Certificate maggiorato di un premio prestabilito;

- a scadenza il valore dell’attività finanziaria sottostante è inferiore al livello di esercizio finale ma superiore o uguale al livello barriera:l’investitore ottiene il pagamento del prezzo di emissione del Certificate senza la corresponsione di alcun premio aggiuntivo;

- a scadenza il valore dell’attività finanziaria sottostante è inferiore al livello barriera: l’investitore perde la protezione condizionata del capitale e subisce la performance negativa che avrebbe maturato investendo direttamente nell’attività sottostante.

Esempio funzionamento degli Express Certificate

Si ipotizzi un Express Certificate avente come attività sottostante l’indice FTSE Mib e avente le seguenti caratteristiche:

| Scadenza | 2 anni |

|---|---|

| Prezzo di emissione | 100€ |

| Data di rilevazione iniziale | 21/07/2014 |

| Valore di riferimento iniziale | 20.000 punti |

| Date di rilevazione intermedie | 21/07/2015 |

| Data di rilevazione finale | 21/07/2016 |

| Importo di esercizio anticipato | 107 € |

| Multiplo | 0,005 |

| Livello barriera | 14.000 punti (pari al 70% del Valore di Riferimento Iniziale) |

| Livello di esercizio anticipato | 100% * valore riferimento iniziale |

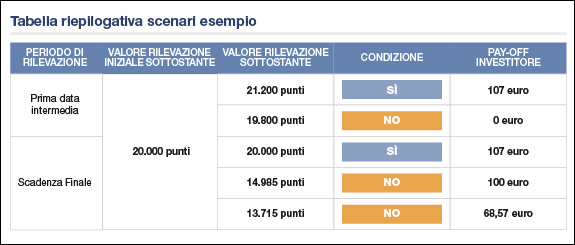

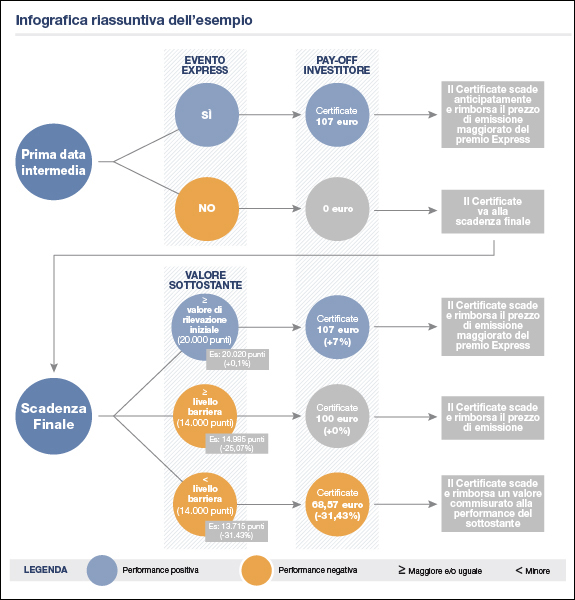

In seguito vengono rappresentati i possibili scenari che nel corso della vita dell’Express Certificate possono manifestarsi all’investitore:

- Prima data di rilevazione intermedia 21 luglio 2015:

- il FTSE Mib quota a un livello pari o superiore a quello di rilevazione iniziale. Il FTSE Mib quota 21.200 punti e l’Express Certificate si estingue anticipatamente. L’investitore riceve il prezzo di emissione di 100 euro più 7 euro, per un totale di 107 euro.

- Il FTSE Mib quota al di sotto del valore di rilevazione iniziale. Il FTSE Mib quota 19.800 punti e l’Express Certificate non si estingue anticipatamente. L’investitore non riceve nessun corrispettivo.

- Scadenza finale 21 luglio 2016:

- il FTSE Mib quota a un livello pari o superiore a quello iniziale. Il FTSE Mib vale 20.020 punti e l’investitore riceve il prezzo di emissione di 100 euro più 7 euro, per un totale di 107 euro;

- il FTSE Mib quota a un livello inferiore a quello iniziale ma superiore al livello barriera. Il FTSE Mib vale 14.985 punti e l’investitore riceve il prezzo di emissione di 100 euro;

- il FTSE Mib quota al di sotto del livello Barriera. Il FTSE Mib vale 13.715 punti e l’investitore perde la protezione condizionata del capitale registrando una perdita. L’attività finanziaria sottostante ha accusato una flessione del 31,425%. Per ogni Certificate detenuto, all’investitore saranno corrisposti 68,57 euro.

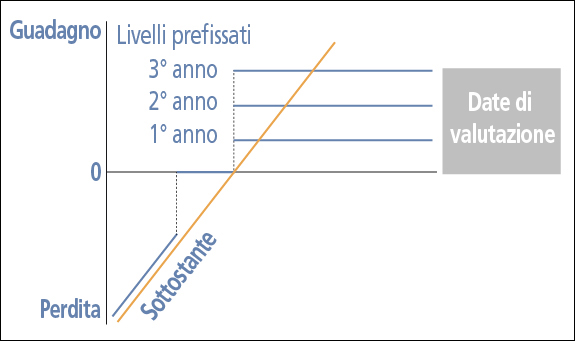

Grafico payoff degli Express Certificate

Di seguito il grafico di un Express Certificate con una durata pari a 3 anni e gli Importi di Esercizio Anticipato caratterizzati dalla presenza dell’Effetto Memoria.

Per approfondimenti sui termini è possibile consultare l' apposito GLOSSARIO