Digital Certificate a Capitale Condizionatamente Protetto

Che cosa è un Digital Certificate a Capitale Condizionatamente Protetto

I Digital Certificate a capitale condizionatamente protetto sono strumenti finanziari che permettono di investire su un’attività finanziaria sottostante, quale ad esempio un’azione, un indice azionario, una valuta, una materia prima o un tasso di interesse. La peculiarità di questo tipo di strumento consiste nella possibilità per l’investitore di ottenere una remunerazione periodica condizionata all’andamento dell’attività sottostante

A chi si rivolge un Digital Certificate a Capitale Condizionatamente Protetto

Questo tipo di Certificate è rivolto agli investitori con elevata propensione al rischio che hanno aspettative di stabilità, moderato rialzo o moderato ribasso del valore dell’attività sottostante. I Digital Certificate a capitale condizionatamente protetto permettono all’investitore di ottenere una remunerazione periodica costituita dal premio e la protezione del capitale è condizionata al fatto che l’attività finanziaria sottostante non scenda (per Digital Certificate long) sotto o salga ( per Digital Certificate short) sopra una determinata soglia, chiamata livello barriera.

Si tratta di un investimento che offre una remunerazione periodica se si verificano determinate condizioni

Quotazione e negoziazione dei Digital Certificate a Capitale Condizionatamente Protetto

I Digital Certificate a capitale condizionatamente protetto sono strumenti finanziari che, in Italia, possono essere acquistati o venduti sui sistemi multilaterali di negoziazione SeDeX e EuroTLX di Borsa Italiana. Le modalità e orari di negoziazione presso tali sistemi multilaterali di negoziazione sono specificati nei relativi regolamenti disponibili sul sito internet di Borsa Italiana. Ad esempio, le negoziazioni continue possono avvenire nei giorni di mercato aperto dalle 9:05 alle 17:30 sul SeDeX e dalle 9:00 alle 17:30 su EuroTLX.

Caratteristiche dei Digital Certificate a Capitale Condizionatamente Protetto

- SOTTOSTANTE: ossia l’azione, l’indice azionario, la valuta, la materia prima o qualsiasi altro asset finanziario o reale da cui dipende il valore del Certificate;

- VALORE DI RILEVAZIONE INIZIALE: ossia il valore dell’attività sottostante fissato alla data di rilevazione iniziale determinata in fase di emissione del Certificate;

- SCADENZA: ossia la data in cui il Certificate cessa di esistere;

- EMITTENTE: ossia l’istituzione finanziaria che ha emesso il Certificate;

- LOTTO MINIMO: ossia il numero minimo di Certificate che possono essere acquistati o venduti;

- ISIN: ossia il codice alfanumerico che identifica in modo univoco lo strumento finanziario;

- LIVELLO BARRIERA: ossia il valore del sottostante sotto il quale l’investitore perde la protezione del capitale;

- IMPORTO DIGITAL: premio predeterminato in fase di emissione che viene corrisposto al detentore del Certificate al verificarsi dell’Evento Digital;

- LIVELLO DIGITAL: ossia la soglia stabilita in fase di emissione che determina l’Evento Digital;

- PERIODO DI VALUTAZIONE DIGITAL: ossia i periodi determinati in fase di emissione nei quali si rileva il verificarsi o meno dell’evento digital.

Funzionamento e pay-off dei Digital Certificate a Capitale Condizionatamente Protetto

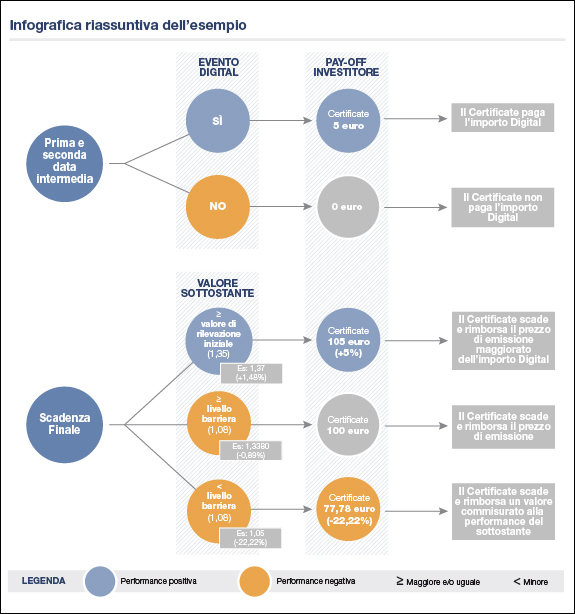

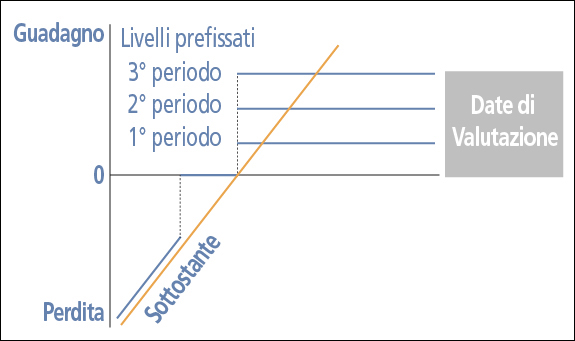

I Digital Certificate a capitale condizionatamente protetto danno la possibilità all’investitore di ottenere una remunerazione periodica costituita dall’Importo Digital stabilito in fase di emissione al verificarsi dell’Evento Digital. L’Evento Digital si realizza quando il valore di riferimento dell'attività sottostante, nei rispettivi periodi di valutazione Digital, risulta pari o superiore (versione Long) o inferiore (versione Short) al Livello Digital. In caso contrario, il Digital Certificate a Capitale condizionatamente protetto non corrisponde alcun premio. A scadenza, la protezione del prezzo di emissione del Certificate è condizionata al mancato raggiungimento di un determinato livello di prezzo, chiamato Livello Barriera, da parte dell’attività finanziaria sottostante. Alla scadenza del Digital Certificate a capitale condizionatamente protetto, nella versione Long, sono tre i possibili scenari in cui può incorrere il detentore del Certificate:

- il valore di rilevazione finale dell’attività finanziaria sottostante è uguale o maggiore a quello di rilevazione iniziale: l’investitore riceve un importo di liquidazione pari al prezzo di emissione incrementato dell’importo digitale;

- il valore di rilevazione finale dell’attività finanziaria sottostante è inferiore a quello di rilevazione iniziale ma superiore al livello Barriera: il capitale è protetto e il prezzo di liquidazione corrisponde a quello di emissione del Certificate;

- il valore di rilevazione finale dell’attività finanziaria sottostante è inferiore al livello Barriera: l’investitore matura una perdita commisurata a quella che avrebbe avuto investendo direttamente nel sottostante alla data di rilevazione iniziale del Certificate.

Esempio funzionamento

Si ipotizzi un Digital Certificate a capitale condizionatamente protetto avente come attività sottostante il cambio eurodollaro e avente le seguenti caratteristiche:

| Scadenza | 3 anni |

|---|---|

| Prezzo di emissione | 100€ |

| Data di rilevazione iniziale | 21/07/2014 |

| Valore di Riferimento Iniziale | 1,35 |

| Date di rilevazione intermedie | 21/07/2015 – 21/07/2016 |

| Data di Rilevazione Finale | 21/07/2017 |

| Livello Digital | 1,35 |

| Importo Digital | 5€ |

| Multiplo | 74,0740 |

| Livello Barriera | 1,08 dollari (pari all’80% del Valore di Riferimento Iniziale) |

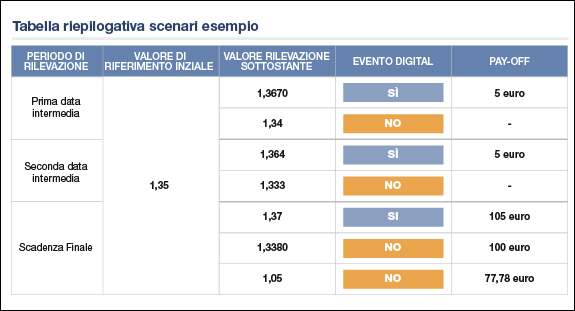

In seguito vengono rappresentati i possibili scenari che nel corso della vita del Digital Certificate a capitale condizionatamente protetto possono manifestarsi all’investitore:

- Prima data di valutazione Digital, 21 luglio 2015:

- l’eurodollaro quota a un livello pari o superiore a quello di rilevazione iniziale (ad esempio a 1,3670). In questo caso la condizione di Evento Digital è verificata. L’investitore riceverà quindi un Importo Digital di 5 euro per ogni Certificate detenuto;

- l’eurodollaro quota a un livello inferiore a quello iniziale (ad esempio 1,34). In questo caso la condizione di Evento Digital non si è verificata. L’investitore non percepisce l’Importo Digital.

- Seconda data di valutazione Digital, 21 luglio 2016:

- l’eurodollaro quota a un livello pari o superiore a quello di rilevazione iniziale (ad esempio a 1,3640). In questo caso la condizione di Evento Digital è verificata. L’investitore riceverà quindi un Importo Digital di 5 euro per ogni Certificate detenuto;

- l’eurodollaro quota a un livello inferiore a quello iniziale (ad esempio 1,3330). In questo caso la condizione di Evento Digital non si è verificata. L’investitore non percepisce l’Importo Digital.

- Scadenza finale 21 luglio 2017:

- l’eurodollaro quota a un livello pari o superiore a quello di rilevazione iniziale (ad esempio a 1,37). In questo caso la condizione di Evento Digital è verificata e l’investitore riceverà i 5 euro dell’Importo Digital. Essendo la data di scadenza finale del Certificate, l’investitore ottiene un Importo di Liquidazione pari al prezzo di emissione del Certificate;

- l’eurodollaro quota a un livello inferiore a quello di rilevazione iniziale (ad esempio 1,3380). In questo caso non si è verificata la condizione di Evento Digital e quindi l’Importo Digital non viene corrisposto ma il mancato raggiungimento di un determinato del Livello Barriera da parte del sottostante permette all’investitore di ottenere un Importo di Liquidazione pari al prezzo di emissione del Certificate;

- l’eurodollaro quota a un livello inferiore a quello rilevazione iniziale e al di sotto del Livello Barriera (ad esempio 1,05). In questo caso non è verificata la condizione di Evento Digital e quindi l’Importo Digital non viene corrisposto. Il valore di rilevazione finale del sottostante è inoltre inferiore alla Barriera e quindi l’investitore perde la protezione del capitale. L’investitore partecipa alla perdita di valore maturata dal sottostante e l’Importo di Liquidazione risulta pari a 77,78 euro.

Grafico payoff dei Digital Certificate a Capitale Condizionatamente Protetto

Per approfondimenti sui termini è possibile consultare l' apposito GLOSSARIO