Accelerator Certificate

Che cosa è l’Accelerator Certificate

Gli Accelerator Certificate sono strumenti finanziari appartenenti alla categoria dei Certificate a capitale condizionatamente protetto e permettono di investire al rialzo su un’attività finanziaria sottostante, quale da esempio un indice azionario o settoriale, una materia prima, un tasso di cambio, un Etf o un fondo. La loro peculiarità è quella di replicare in modo più che proporzionale l’andamento del sottostante.

A chi si rivolge l'Accelerator Certificate

Questo tipo di Certificate è rivolto agli investitori con una propensione al rischio elevata, che hanno una visione direzionale sull’evoluzione dei valori dell’attività finanziaria sottostante e disposti a rischiare il capitale investito in caso di scenario negativo in quanto il pay-off finale è funzione della performance dell’attività sottostante durante il periodo di vita del Certificate.

Investimento adatto a chi vuole partecipare in modo più che proporzionale all’andamento del sottostante

Quotazione e negoziazione degli Accelerator Certificate

I Certificate Accelerator sono strumenti finanziari che, in Italia, possono essere acquistati o venduti sui sistemi multilaterali di negoziazione SeDeX e EuroTLX di Borsa Italiana. Le modalità e orari di negoziazione presso tali sistemi multilaterali di negoziazione sono specificati nei relativi regolamenti disponibili sul sito internet di Borsa Italiana. Ad esempio, le negoziazioni continue possono avvenire nei giorni di mercato aperto dalle 9:05 alle 17:30 sul SeDeX e dalle 9:00 alle 17:30 su EuroTLX.

Caratteristiche dell’Accelerator Certificate

- SOTTOSTANTE ossia l’azione, l’indice azionario, la valuta, la materia prima o qualsiasi altro asset finanziario o reale da cui dipende il valore del Certificate;

- VALORE DI RILEVAZIONE INIZIALE o STRIKE PRICE ossia il valore dell’attività sottostante fissato alla data di rilevazione iniziale determinata in fase di emissione del Certificate;

- LIVELLO BARRIERA ossia il valore del sottostante sotto il quale l’investitore perde la protezione del capitale;

- SCADENZA ossia la data in cui il Certificate cessa di esistere;

- EMITTENTE ossia l’istituzione finanziaria che ha emesso il Certificate;

- LOTTO MINIMO ossia il numero minimo di Certificate che possono essere acquistati o venduti;

- ISIN ossia il codice alfanumerico che identifica in modo univoco lo strumento finanziario;

- FATTORE DI PARTECIPAZIONE espresso in percentuale, rappresenta il valore moltiplicativo della performance del sottostante riconosciuta a scadenza nel caso in cui il valore di rilevazione finale del sottostante sia superiore a quello di rilevazione iniziale;

- AIR BAG caratteristica del Certificate che si attiva quando a scadenza il valore di rilevazione finale del sottostante vìola il livello Barriera e che permette all’investitore di subire una perdita minore rispetto a quella che avrebbe avuto investendo direttamente sull’attività finanziaria sottostante;

- MULTIPLO ossia la quantità di sottostante controllata da ciascun Certificate e pari al rapporto tra il prezzo di sottoscrizione in fase di emissione del Certificate e il Valore di Riferimento Iniziale dell’attività finanziaria sottostante;

- CAP espresso in percentuale, rappresenta il limite massimo di partecipazione al guadagno del sottostante che l’emittente riconosce, a scadenza, al possessore del Certificate;

Funzionamento e pay-off dell'Accelerator Certificate

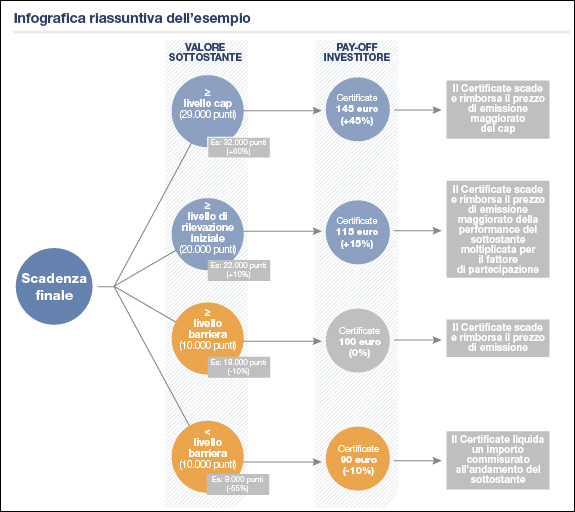

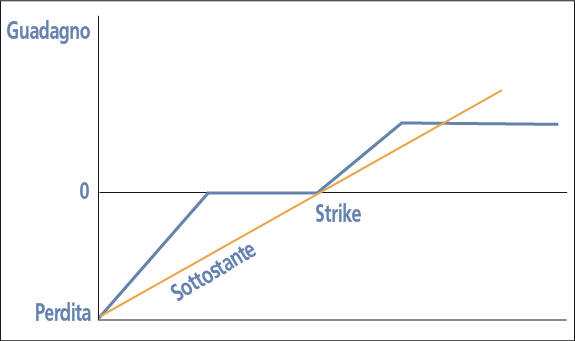

La caratteristica principale degli Accelerator Certificate è di replicare in modo più che proporzionale l’andamento dell’attività finanziaria sottostante in base al fattore di partecipazione, permettendo all’investitore di attenuare le perdite maturate dall’attività sottostante nel corso della vita del Certificate grazie all’”Air Bag”, ovvero un fattore che si attiva qualora a scadenza il valore del sottostante abbia violato il “livello barriera”. La partecipazione ai movimenti dell’attività finanziaria sottostante può essere limitata a un valore massimo, chiamato cap. A scadenza possono verificarsi i seguenti scenari:

- il valore di rilevazione finale dell’attività finanziaria sottostante è superiore a quello iniziale In questo caso l’investitore ottiene il pagamento del prezzo di emissione del Certificate maggiorato della performance maturata dal sottostante e moltiplicata per il fattore di partecipazione;

- il valore di rilevazione finale dell’attività finanziaria sottostante è inferiore a quello di rilevazione iniziale ma non si è verificato l’evento Barriera In questo caso l’investitore ottiene il pagamento del prezzo di emissione del Certificate;

- il valore di rilevazione finale dell’attività finanziaria sottostante è inferiore al livello Barriera In questo caso l’investitore perde la protezione condizionata del capitale ma il fattore Airbag permette all’investitore di attenuare le perdite. In qualunque caso, l’importo di liquidazione non potrà essere superiore al prezzo di emissione del Certificate.

Esempio di funzionamento dell’Accelerator Certificate

Si ipotizzi un Accelerator Certificate avente come attività sottostante l’indice FTSE Mib con le seguenti caratteristiche:

| Scadenza | 2 anni |

|---|---|

| Prezzo di emissione | 100€ |

| Data di rilevazione iniziale | 21/07/2014 |

| Valore di Riferimento iniziale | 20.000 Punti Indice |

| Data di rilevazione finale | 21/07/2016 |

| Fattore di partecipazione | 150% |

| Livello di Rimborso Massimo | 145 Eur (Cap al 145%) |

| Livello barriera | 10.000 Punti Indice (pari al 50% del Valore di Riferimento Iniziale) |

| Fattore Air Bag | 200% |

Alla scadenza del Certificate viene rilevato il valore dell’attività finanziaria sottostante e gli scenari possibili per l’investitore sono:

- il valore finale del FTSE Mib è superiore al livello di rilevazione iniziale e pari a 32.000 punti (+60%). In questo caso la performance maturata dal FTSE Mib è superiore al Cap fissato in fase di emissione. L’importo di liquidazione riconosciuto all’investitore per ogni Certificate detenuto è così uguale al livello di rimborso massimo, ossia pari a 145 euro;

- il valore finale del FTSE Mib è superiore al livello di rilevazione iniziale e pari a 22.000 punti (+10%). Usando i valori ipotizzati nell’esempio, l’importo di liquidazione riconosciuto all’investitore per ogni Certificate detenuto è pari a:

Importo di liquidazione = {{20.000 punti + [(22.000 punti – 20.000 punti) x 1,5]} x 0,005} = 115 euro; - il valore finale del FTSE Mib è inferiore al livello di rilevazione iniziale ma superiore al livello barriera. Ipotizziamo un valore del FTSE Mib pari a 18.000 punti (-10%). In questo caso l’investitore non accusa la performance negativa registrata dall’attività finanziaria sottostante nel periodo di vita del Certificate in quanto il valore finale del sottostante soddisfa la condizione di protezione del Capitale. L’importo di liquidazione riconosciuto all’investitore per ogni Certificate detenuto è così uguale al prezzo di emissione, ossia pari a 100 euro;

- il valore finale del FTSE Mib è inferiore al livello di rilevazione iniziale e a quello del livello Barriera. Ipotizziamo un valore del FTSE Mib pari a 9.000 punti (-55%). Usando i valori ipotizzati nell’esempio, l’importo di liquidazione riconosciuto all’investitore per ogni Certificate detenuto è pari a:

Importo di liquidazione = (9.000 punti x 2 x 0,005) = 90 euro (-10%).

Esempio grafico payoff Accelerator Certificate

Per approfondimenti sui termini è possibile consultare l' apposito GLOSSARIO