Le obbligazioni strutturate

Cosa sono le obbligazioni strutturate?

Le obbligazioni strutturate sono prodotti finanziari a rendimento variabile che nascono dalla combinazione di uno strumento di debito di tipo tradizionale, a tasso fisso o variabile, con uno o più contratti derivati. Solitamente questi contratti derivati sono legati all’andamento di titoli azionari, indici, valute, tassi di interesse o titoli obbligazionari. La componente obbligazionaria offre il rimborso a scadenza del valore nominale e, se previsto, la ricezione di cedole periodiche. La componente derivativa incide invece sulla variabilità del rendimento finale dell’investimento.

I rendimenti di queste obbligazioni sono legati all’andamento di titoli azionari, indici valute, tassi…

Quotazione e negoziazione

Le obbligazioni strutturate sono strumenti finanziari che, in Italia, possono essere acquistati o venduti sia sul mercato MOT che sul sistema multilaterale di negoziazione EuroTLX di Borsa Italiana, qualora vengano rispettivamente quotati e/o ammessi a negoziazione su tali mercati. Le modalità e orari di negoziazione sul mercato MOT e EuroTLX sono specificati nei relativi regolamenti disponibili sul sito internet di Borsa Italiana. Ad esempio, in entrambi i mercati, le negoziazioni continue possono avvenire nei giorni di mercato aperto dalle 9:00 alle 17:30.

Elementi standard

La componente obbligazionaria delle obbligazioni strutturate, chiamata anche contratto ospite, ha delle caratteristiche standard. Questi elementi sono:

- VALORE NOMINALE, ossia il valore che sarà rimborsato a scadenza dall’obbligazione;

- CEDOLA o COUPON, ossia l’interesse periodico che l’emittente paga ai propri obbligazionisti;

- SCADENZA, ossia la data in cui viene ripagato all’obbligazionista il valore nominale del bond;

- EMITTENTE, ossia la società o lo Stato che hanno emesso lo strumento di debito.

Rendimento

Sono diverse le componenti che incidono sul rendimento finale di un’obbligazione strutturata. Da un lato il prezzo di emissione dell’obbligazione, dall’altro la componente legata alla ricezione delle cedole periodiche (in base al tipo di tasso previsto in fase di emissione, fisso o variabile) e alla componente derivativa. Un ulteriore elemento che incide sul rendimento di un’obbligazione è il merito creditizio dell’emittente: più elevata sarà la qualità del merito creditizio, minore sarà il rendimento dell’obbligazione rispetto a uno strumento obbligazionario di pari durata e caratteristiche.

Il prezzo di emissione

Per quel che riguarda la componente prezzo di emissione, vi sono tre possibili prezzi cui può essere emessa un’obbligazione:

- alla pari, ossia il prezzo di emissione coincide con il valore nominale di rimborso a scadenza dell’obbligazione (pago un bond 100 euro e a scadenza mi vengono restituiti 100 euro). In questo caso il prezzo del bond non influisce né positivamente né negativamente sul rendimento complessivo a scadenza dell’obbligazione;

- sotto la pari, ossia il prezzo di emissione è inferiore al valore nominale di rimborso (pago un titolo 98 euro e a scadenza mi saranno restituiti 100 euro). Per le obbligazioni che prevedono il pagamento delle cedole, questa differenza di prezzo rappresenta un elemento che aumenta il rendimento complessivo ottenibile a scadenza. Per le obbligazioni che non prevedono il pagamento periodico delle cedole, i cosìddetti zero coupon bond, la differenza di prezzo rappresenta il rendimento complessivo che l’investitore otterrà a scadenza;

- sopra la pari, ossia il prezzo di emissione è maggiore del valore nominale che verrà riconosciuto a scadenza all’investitore (pago un titolo 102 euro e a scadenza mi saranno restituiti 100 euro). Questo prezzo maggiorato incide negativamente sul rendimento complessivo dell’obbligazione.

Funzionamento

In assenza di eventi straordinari che portino all’insolvenza dell’emittente o al venir meno della garanzia del rimborso del capitale, chi investe in obbligazioni strutturate a scadenza ottiene la restituzione del valore nominale dell'obbligazione. La presenza della componente derivata, funzionale all’obiettivo di offrire un rendimento superiore alle tradizionali obbligazioni, impatta sul profilo di rendimento finale per l’investitore incrementando il rischio del titolo obbligazionario. Proprio la presenza della parte derivativa porta a possibili e significative modificazioni dei flussi di cassa ottenibili nel corso della vita dell’obbligazione.

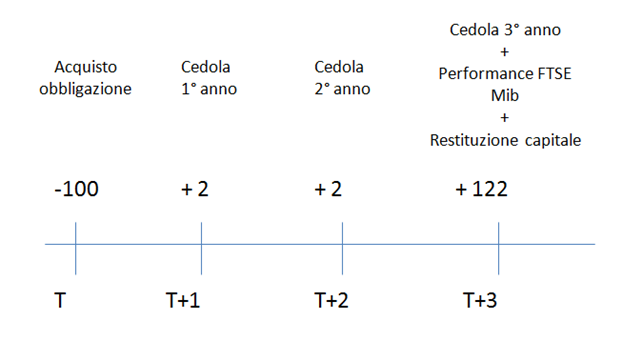

Esempio funzionamento obbligazione index linked

Ipotizzando un’obbligazione linked di durata 3 anni, prezzo di emissione 100, che prevede un rendimento fisso del 2% annuo e un extra rendimento dato, a scadenza, dalla replica della performance del FTSE Mib nel periodo di durata dell’obbligazione, performance ipotizzata pari al 20%, l’investitore ottiene il seguente flusso di cassa:

Capitale investito: 100 Capitale incassato a scadenza: 126

Principali tipi di obbligazioni strutturate

In base alle caratteristiche specifiche della componente derivativa, le obbligazioni strutturate vengono classificate in diverse macrocategorie. Di seguito le principali tipologie di obbligazioni strutturate:

Obbligazioni linked

Sono obbligazioni il cui rendimento è collegato all'andamento di determinati prodotti finanziari o reali, quali azioni o panieri di azioni, indici, tassi di cambio, materie prime o altri sottostanti. Alla scadenza la componente obbligazionaria offre il rimborso del valore nominale dell’obbligazione, quella opzionale il premio, commisurato all’andamento dell’attività finanziaria o reale sottostante.

Obbligazioni callable

Le obbligazioni Callable sono bond muniti di una clausola che attribuisce all'emittente la facoltà di rimborsare anticipatamente il prestito. L’opzione concessa all’emittente consente all’investitore di ottenere un tasso di interesse superiore a quello corrente di mercato per strumenti di analoga durata e merito creditizio dell’emittente.

Obbligazioni cap and floor

Le obbligazioni Cap and Floor sono titoli a tasso variabile che garantiscono un minimo tasso cedolare e un massimo. Il Floor indica nello specifico il valore minimo del tasso di interesse con cui verranno calcolate le cedole, anche in caso di discese del tasso di riferimento sotto questo livello. Il Cap indica il valore di tasso di interesse massimo che verrà usato per calcolare il flusso cedolare dell’investitore. Rialzi del tasso di mercato oltre tale soglia non si traducono in un maggior rendimento per l’investitore, con l’obbligazione che in quel caso si comporta come un’obbligazione a tasso fisso.

Obbligazioni Plain Vanilla

Obbligazioni strutturate